AccountingMajors and Minor

The Accounting Program at Gustavus Adolphus College is committed to providing a quality accounting education in contemporary subject matters and to supporting the student’s technical accounting coursework with a broad set of skills, knowledge and experiences in the liberal arts tradition.

We strive to prepare students to face challenges of a global business environment and to become active and engaged citizens who are able to apply accounting and business knowledge for the betterment of their communities.

Why study accounting at a liberal arts college?

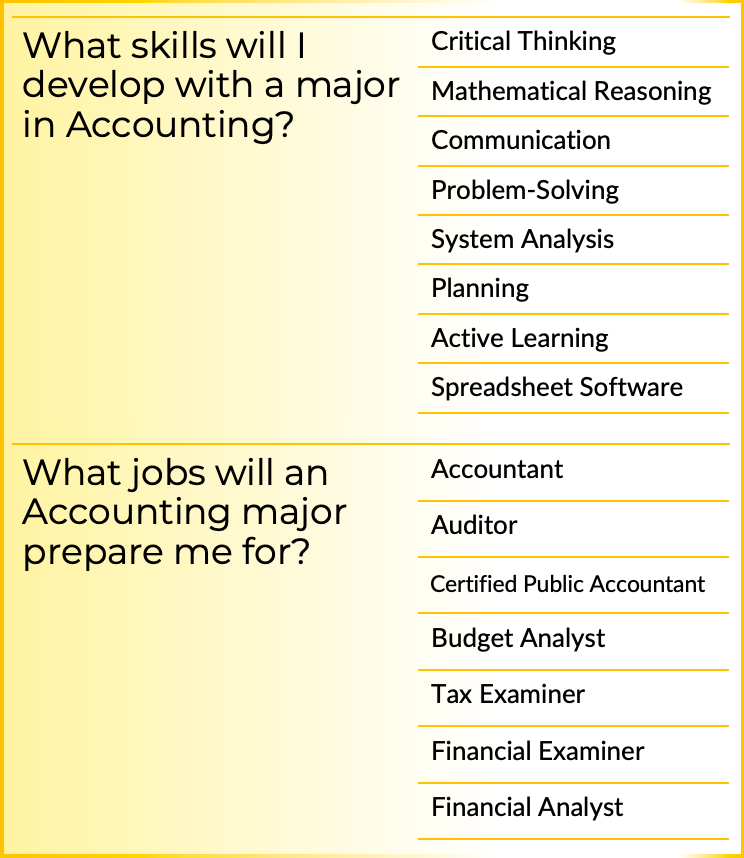

Employers today demand the communication skills, critical thinking skills, and other core competencies developed in a liberal arts college curriculum.

Why Gustavus?

1. Our program, with the use of for-credit internships allows many students to reach the credit hour requirement for the CPA exam in four years, rather than five years, as is the case in accounting programs at other colleges.

2. With proper planning, many students are able to experience paid internships during their final semester while still graduating in four years.

3. All students have access to the services of the Gustavus Career Development Center, where students can obtain career interest guidance, resume assistance, interview skills training, and access to the Center’s robust listing of internship and job placement opportunities.

4. Students may join the Gustavus Mentoring Program that connects students on campus with members of the Gustavus alumni community.

5. All faculty teaching accounting courses at Gustavus are Certified Public Accountants who have significant public accounting experience and/or industry experience

Prerequisite

E/M-108 (Principles of Microeconomics) is a prerequisite for further work in the department unless the student receives approval of an alternate from the department chairperson.

Accounting Majors

Students should complete the Mathematics and Required Departmental Core Courses during their First Year. If not, these courses should be completed no later than the end of their Sophomore year. Students must complete the Departmental Core before enrolling in Level II or Level III courses in the Economics and Management Department. Students must complete the Departmental Mathematics requirement before enrolling in Level III courses. Non-majors who wish to take Level II or III courses without having completed the above prerequisites may enroll with the permission of the instructor.

There are three Accounting majors offered at Gustavus:

The Accounting Major is a good program for those who do not plan to become Certified Public Accountants (CPAs) and those who plan to complete an MBA before getting a CPA license. Students completing this program are prepared for a variety of entry-level positions in public accounting, private industry, or government. Those who complete this major may sit for the CPA exam in Minnesota, but must take additional courses to receive a license from the Minnesota Board of Accountancy.

The Accounting Major with a Finance Concentration is a good program for those who plan to pursue careers in corporate accounting or corporate finance. Through the Finance Concentration, students will acquire knowledge about how firms make financial decisions and how these decisions affect individual organizations and society as a whole.

The Public Accounting Major is designed for students who want to complete the education requirements for CPA licensure in Minnesota prior to graduating from Gustavus. Students should be aware that other states may have different requirements for licensure. Students who wish to obtain a certificate in a state other than Minnesota should contact the Board of Accountancy in that state as soon as possible and work with their advisor to take courses that meet these requirements. Note: Completion of all requirements for the Public Accounting major may take more than eight semesters of study. However, with careful planning, and the use of for-credit internships enable most students to complete the Public Accounting major in 8 semesters.

This section lists the requirements of the Accounting majors. A grade of C- or higher is required for each course counted toward the major and a departmental GPA of 2.33 or higher is required for all departmental courses counted toward the majors. The specific requirements are as follows:

- Math Requirements

- MCS-142 Introduction to Statistical Methods

- E/M-150 Applied Business Analytics

- Departmental Core

- E/M-108 Principles of Microeconomics

- E/M-109 Principles of Macroeconomics or E/M 160 Introduction to Management

- E/M-110 Financial Accounting

- Additional Courses for Each Major as Follows:

- Accounting Major

- Accounting Requirements

- E/M-230 Managerial Accounting

- E/M-231 Intermediate Accounting I

- E/M-232 Intermediate Accounting II

- E/M-240 Cost Accounting

- E/M-330 Auditing

- E/M-340 Federal Taxation

- Accounting Electives: One of the following courses required

- E/M-241 Accounting Information Systems

- E/M-339 Advanced Accounting

- Management Requirements

- E/M 265 Business Law

- Department Electives: Two of the following courses required

- E/M-251 Ethics in Business and Economics

- E/M-260 Marketing

- E/M-261 Organizational Behavior and Management

- E/M-270 Business Finance

- E/M-350 Human Resource Management

- E/M-351 Globalization and International Organizations

- E/M-353 Operations Management

- E/M-360 Managerial Economics

- E/M-370 Managerial Finance

- E/M-371 Investments

- Accounting Requirements

- Accounting Major with a Finance Concentration

- Accounting Requirements

- E/M-230 Managerial Accounting

- E/M-231 Intermediate Accounting I

- Accounting Electives: Two of the following courses required

- E/M-232 Intermediate Accounting II

- E/M-240 Cost Accounting

- E/M-340 Federal Taxation

- Management Requirements

- E/M 265 Business Law

- Finance Requirements

- E/M 270 Business Finance

- E/M 370 Managerial Finance

- E/M 371 Investments

- Economics Electives: Two of the following courses required

- E/M 360 Managerial Economics

- E/M 384 International Trade and Finance

- E/M 385 Public Finance

- Approved E/M 244/344 Special Topics

- Accounting Requirements

- Public Accounting Major

- Accounting Requirements

- E/M-230 Managerial Accounting

- E/M-231 Intermediate Accounting I

- E/M-232 Intermediate Accounting II

- E/M-240 Cost Accounting

- E/M 241 Accounting Information Systems

- E/M-330 Auditing

- E/M-339 Advanced Accounting

- E/M-340 Federal Taxation

- Management Requirements

- E/M 265 Business Law

- Department Electives: Two of the following courses required

- E/M-251 Ethics in Business and Economics

- E/M-260 Marketing

- E/M-261 Organizational Behavior and Management

- E/M-270 Business Finance

- E/M-350 Human Resource Management

- E/M-351 Globalization and International Organizations

- E/M-353 Operations Management

- E/M-360 Managerial Economics

- E/M-370 Managerial Finance

- E/M-371 Investments

- Complete a total of 37.5 courses, no more than .5 course of Physical Education activities or more than 4 courses of career exploration/ internship. Note that Public Accounting majors are able to count up to four J-term courses towards graduation requirements while Accounting majors can count two J-term courses towards graduation requirements.

- Accounting Requirements

- Accounting Major

Accounting Minor

This program is a good choice for students who are pursuing a major outside of the Economics and Management Department and wish to increase their knowledge of how financial information is compiled, presented, and utilized for decision making.

The Accounting minor is available with prior approval by the student’s departmental advisor and the department chair. A grade of C– or higher is required in each of the courses in the minor, along with an overall GPA of 2.333 for the minor. All Economics and Management courses must be taken at Gustavus to apply toward this minor.

- Math and Department Requirements

- E/M-125 Statistics for Economics and Management or MCS-121 Calculus I

- E/M-108 Principles of Microeconomics or E/M-109 Principles of Macroeconomics or E/M 160 Introduction to Management

- Accounting Requirements

- E/M-110 Financial Accounting

- E/M-230 Managerial Accounting

- E/M-231 Intermediate Accounting I

- E/M-232 Intermediate Accounting II or E/M-240 Cost Accounting